From January to October 2022, the sales penetration rate of global new energy passenger vehicles reached 13%; China's domestic penetration rate is up to 24%, and 25% if the November figures are combined. Electric acceleration penetration, with the acceleration of the layout of 800V electronic control system to solve the "range anxiety", automotive SiC device demand for explosive growth. The global market is expected to reach $1.6 billion in 2022 and $4.6 billion in 2026, with a CAGR of 30.2%.

According to the data of China Automobile Industry Association, from January to November, China's passenger car production and sales completed 21.702 million and 21.292 million respectively, with year-on-year growth of 14.7% and 11.5% respectively, and the cumulative growth slowed down. Affected by the epidemic, both wholesale and terminal markets are under great pressure. The policy of halving the purchase tax to promote consumption this year has played a significant role in stabilizing the growth of the car market, but the epidemic in the second half of the year has affected the implementation of the policy.

From January to November, the production and sales of new energy vehicles were 6.253 million and 6.067 million respectively, with a year-on-year increase of twice and a market share of 25%.

From January to November, the sales volume of the top ten enterprise groups with new energy vehicle sales totaled 4.999 million, up 1.2 times from the same period last year, accounting for 82.4% of the total sales volume of new energy vehicles, 5.8 percentage points higher than the same period last year. Among the top ten enterprises in new energy sales, BYD has accumulated sales of more than 1.6 million vehicles. Compared with the same period last year, various enterprises have shown different degrees of growth, with Geely's sales growth being the most significant

According to the data released by the Passenger Transport Federation, China's wholesale of new energy passenger vehicles from January to November was 5.742 million, up 104.6% year on year. In November, the retail sales of new energy passenger vehicles reached 598000 units, up 58.2% year on year and 7.8% month on month. From January to November, the trend was upward. From January to November, domestic retail sales of new energy passenger vehicles were 5.03 million, up 100.1% year on year.

In the new energy vehicle market, the improvement of supply combined with the high oil price led to the market boom. The high oil price and the locked electricity price led to the continued strong performance of electric vehicle orders. The month-on-month trend of new energy vehicles and traditional fuel vehicles in November was affected by epidemic prevention measures in individual regions, and the situation of store closure was more prominent. The epidemic prevention and control efforts in all regions are strong, and the important customer collection methods at the store have a certain degree of impact. However, some new energy manufacturers have a good accumulation of orders, coupled with flexible price promotion, and the increase of head manufacturers is obvious.

In addition, since January 22 next year is the earliest Spring Festival in history, the sales peak before the Spring Festival will be started in December ahead of time, and some regions will have car purchase subsidy policies to boost consumption before the end of December. Therefore, the pre-holiday consumption peak and the rush purchase peak of policy withdrawal will be superimposed to promote the higher retail sales in December.

The Federation pointed out that this year's new energy subsidy rebate rate is the highest of 12600 yuan, far higher than the 5000 yuan subsidy rebate rate of the previous two years, and superimposed with the information that some auto companies announced the price increase of models in the next year, so this rebate policy should also have a very good role in promoting the effect of new energy rush purchase at the end of the year for consumers. This year, the new energy vehicle market is expected to achieve the annual sales forecast of 6.5 million vehicles put forward in its earlier stage.

According to the agency, if there is no policy support, it is estimated that the total retail sales of passenger cars will increase by 1% in 2023, with a zero growth of 20.6 million. It is estimated that the wholesale of new energy passenger vehicles will reach 8.4 million in 2023, an increase of 30%..

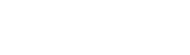

11月动力电池产量数据

According to the data released by the China Automotive Power Battery Industry Innovation Alliance, from January to November, China's total power battery output was 489.2GWh, up 160.1% year on year. The cumulative output of ternary battery is 190.0GWh, accounting for 38.8% of the total output, with a cumulative year-on-year increase of 130.6%; The cumulative output of lithium iron phosphate battery is 298.5GWh, accounting for 61.0% of the total output, with a cumulative year-on-year increase of 183.4%.

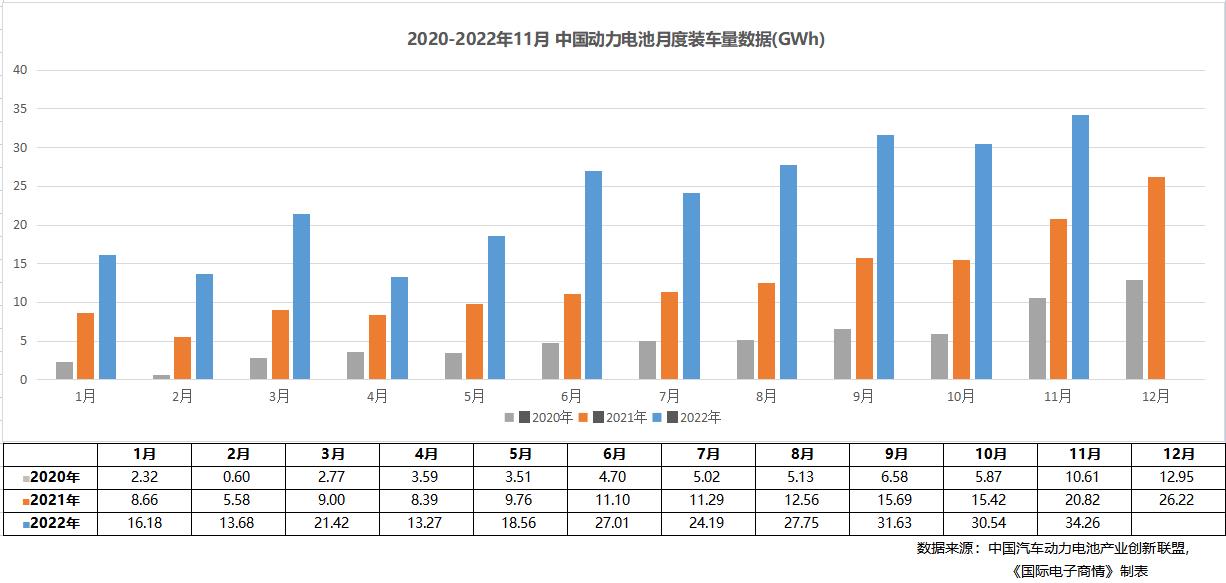

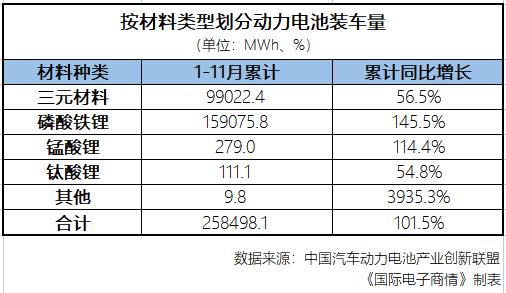

From January to November, China's power battery cumulative load was 258.5GWh, up 101.5% year on year. Among them, the accumulative load of ternary battery is 99.0GWh, accounting for 38.3% of the total load, with a year-on-year increase of 56.5%; The cumulative load of lithium iron phosphate battery was 159.1GWh, accounting for 61.5% of the total load, with a cumulative year-on-year increase of 145.5%.

Vehicle installation of power battery in January

From January to November, China's power battery cumulative load was 258.5GWh, up 101.5% year on year. Among them, the accumulative load of ternary battery is 99.0GWh, accounting for 38.3% of the total load, with a year-on-year increase of 56.5%; The cumulative load of ferrophosphate battery was 159.1GWh, accounting for 61.5% of the total load, with a cumulative year-on-year increase of 145.5%.

(In November, China's power battery loading volume was 34.3GWh, with a year-on-year increase of 64.5%, and a month-on-month increase of 12.2%. Among them, the ternary battery loading volume was 11.0 GWh, accounting for 32.2% of the total loading volume, with a year-on-year increase of 19.5%, and a month-on-month increase of 2.0%; the ferric phosphate battery loading volume was 23.1 GWh, accounting for 67.4% of the total loading volume, with a year-on-year increase of 99.5%, and a month-on-month increase of 17.4%.)

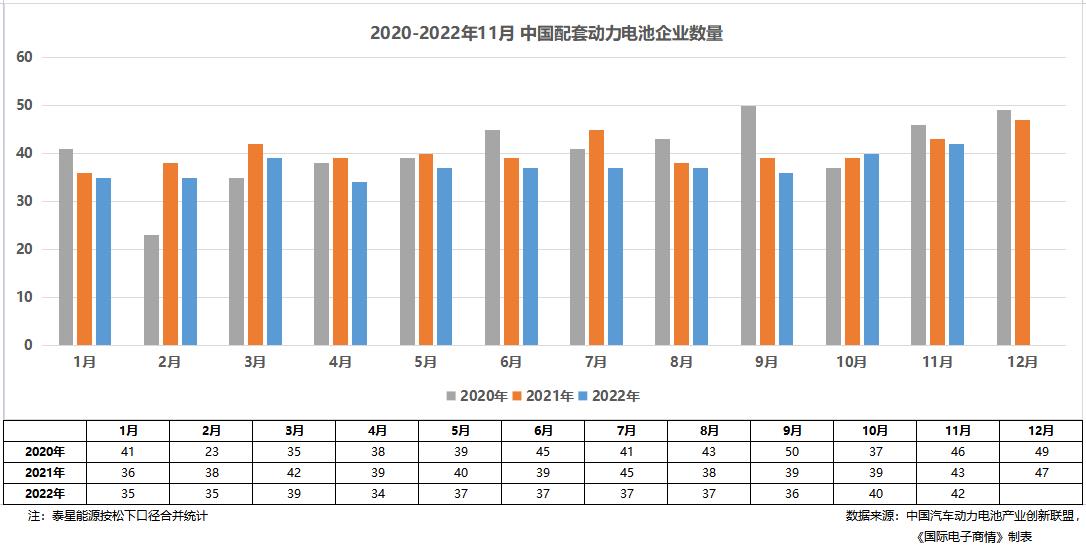

Concentration level of loading volume of power battery enterprises in China in November

In November, a total of 42 power battery enterprises in China's new energy vehicle market realized vehicle loading and matching, a decrease of 1 compared with the same period last year. The top 3, top 5 and top 10 power battery enterprises have 28.3GWh, 30.4GWh and 32.9GWh respectively, accounting for 82.5%, 88.7% and 96.0% of the total installed vehicles.

In January-November, a total of 56 power battery enterprises in China's new energy vehicle market achieved vehicle loading, an increase of 1 compared with the same period last year. The power battery loading capacity of the top 3, top 5 and top 10 power battery enterprises was 201.3GWh, 219.6GWh and 244.7GWh respectively, accounting for 77.9%, 85.0% and 94.7% of the total vehicle load.

Average load capacity of single vehicle by vehicle type (kWh)

In November 2022, China's average installed capacity of new energy vehicles by vehicle type was 48.5kWh, up 3.0% month-on-month. Among them, the average charged capacity of single vehicle of pure electric passenger cars and pure electric passenger cars was 53.2kW/vehicle and 202.3kW/vehicle respectively, with a month-on-month increase of 0.1% and a decrease of 5.8%.

Energy density distribution of battery system of pure electric passenger vehicles (10000 vehicles)

In November 2022, the output of China's pure electric passenger vehicle system with energy density of 140 (including) - 160 Wh/kg and 160 Wh/kg and above was 206000 and 96000, accounting for 42.1% and 19.6% respectively, and the output of vehicles with energy density of 125 Wh/kg and below was 65000, accounting for 13.3%.

According to the data of China Electric Vehicle Charging Infrastructure Promotion Alliance (China Charging Alliance), as of November 2022, the member units of the Alliance reported a total of 1.731 million public charging piles, including 732000 DC charging piles and 9.99 million AC charging piles. From December 2021 to November 2022, about 53000 public charging piles will be added every month.

The operation of public charging infrastructure at the provincial, regional and municipal levels. The proportion of public charging piles built in Guangdong, Jiangsu, Zhejiang, Shanghai, Beijing, Hubei, Shandong, Anhui, Henan and Fujian TOP10 areas reached 71.4%. The charging power of the country is mainly concentrated in Guangdong, Jiangsu, Sichuan, Zhejiang, Hebei, Fujian, Shanghai, Shaanxi, Beijing, Hunan and other provinces. The flow of electricity is mainly buses and passenger vehicles, while the proportion of other types of vehicles such as sanitation logistics vehicles and taxis is relatively small. In November 2022, the total charging capacity of the country will be about 1.99 billion kilowatt-hours, a decrease of 0.7 billion kilowatt-hours compared with the previous month, an increase of 83.9% year-on-year and a decrease of 3.6% month-on-month.

The overall operation of charging infrastructure: from January to November 2022, the increment of charging infrastructure was 2.332 million, of which the increment of public charging piles increased by 105.4% year on year, and the increment of private charging piles built with vehicles continued to increase by 316.5% year on year. As of November 2022, the total number of charging infrastructure nationwide was 4.949 million, an increase of 107.5% year on year.

The comparison between charging infrastructure and electric vehicles shows that from January to November 2022, the increment of charging infrastructure will be 2.332 million, and the sales of new energy vehicles will be 6.067 million. The charging infrastructure and new energy vehicles will continue to grow explosively. The pile-car increment ratio is 1:2.6, and the construction of charging infrastructure can basically meet the rapid development of new energy vehicles.

As of November 2022, the construction of private charging infrastructure for about 3.651 million vehicles has been sampled by the whole vehicle enterprises in the alliance, including 3.218 million private charging piles built with vehicles.

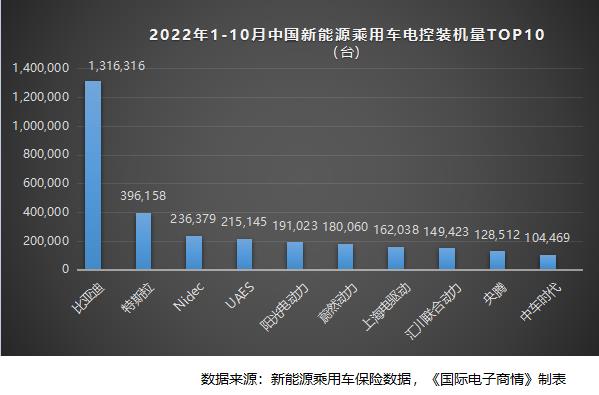

According to the insurance data of new energy passenger vehicles, the installed capacity of electric control and motor of new energy passenger vehicles and its ranking from January to October 2022 were counted, among which the top 10 electric control of new energy passenger vehicles accounted for 69.3%; Top 10 electric motors for new energy passenger vehicles, accounting for 70.9% of the total. The whole industry shows the phenomenon of head aggregation, and the accessory manufacturers and the main engine manufacturers are both honored; This year, BYD's electric control and motor installed capacity are significantly ahead of other manufacturers in the industry. After all, 2022 is the highlight year of BYD, and the sales of related accessories should be significantly ahead.

From January to October 2022, the sales penetration rate of global new energy passenger vehicles will reach 13%; China's domestic penetration rate is up to 24%. If the data in November are combined, the penetration rate is up to 25%. The penetration of electrification is accelerating. As the automobile enterprises accelerate the layout of 800V electronic control system to solve the "mileage anxiety", the demand for on-board SiC devices is experiencing explosive growth. It is estimated that the global market size will reach 1.6 billion dollars in 2022, and is expected to reach 4.6 billion dollars in 2026, with CAGR reaching 30.2%.

At the same time, with the continuous upgrading and iteration of intelligence, it is expected that the global penetration rate of L2 and above vehicles will increase from 18% in 2021 to 86% in 2030, and the penetration rate of L3+smart vehicles will increase from 1% in 2022 to 56% in 2030, which will lead to the growth of demand for various types of vehicle specification semiconductors such as CIS, SOC, MCU, storage, as well as multiple types of vehicle optical components such as cameras, laser radars, AR-HUD, etc. According to Omdia's prediction, the global automotive semiconductor market will exceed US $80 billion in 2025, and the CAGR will reach 15% in 2021-25.

According to Deloitte report data, compared with traditional fuel vehicles, the number of chips used by new energy vehicles has gradually increased. Take automatic driving technology as an example. The higher the level of automatic driving, the more the number of sensors is required. L3 level automatic driving carries 8 sensor chips on average, while L5 level automatic driving requires 20 sensor chips.

Similarly, the amount of information that the vehicle needs to process and store is also positively related to the maturity of automatic driving technology, further improving the carrying capacity of control chips and storage chips. According to statistics, by 2022, the number of chips carried by new energy vehicles in a single vehicle will be about 1459, gradually distancing from the number of chips carried by traditional fuel vehicles.

In addition, new energy vehicles with electric power system as the power source have higher requirements for power management and power conversion of electronic components, which improves the value of automobile chips. With the gradual maturity of automatic driving technology, the price of single car chip will also be higher. According to statistics, the BOM (bill of materials) value of automotive electronic components will be significantly improved by 2025, mainly due to the demand of new energy vehicle battery management and electric powertrain for electronic components (such as inverter, powertrain domain controller DCU, various sensors, etc.).

Previously, Zhang Yongwei, vice chairman and secretary general of the China Electric Vehicle Hundred People's Congress, said at the Global Smart Car Industry Summit (GIV2022) held on December 16, "At present, the domestic supply of automotive chips is less than 10%, that is, more than 90% of the chips of each car are imported or provided by foreign local companies."

Zhang Yongwei pointed out that in 2022, the penetration rate of China's automobile intelligence will exceed 30%, and this proportion will reach 70% by 2030. Judging from the popularity of intelligence, China's demand for automotive chips will see explosive growth. He said that the demand for automotive chips is growing and the gap is also growing. By 2030, the scale of China's auto chip market will reach about US $30 billion, and the demand will be between 100 billion and 120 billion pieces/year.

Automotive power device

The industry believes that power semiconductors will become the most expensive components of a single car, and are also the most likely breakthrough in the field of automotive semiconductors for domestic enterprises at this stage.

According to the data provided by Infineon, the electric motor has become the main source of power output in the plug-in hybrid pure electric vehicle type. The average value of power semiconductors has risen to $330, and the overall content of single vehicle semiconductors has also risen to $834. Therefore, in the process of automobile electrification, the consumption and value of power semiconductors have increased significantly. The two most representative power devices are IGBT and MOSFET.

According to Omdia's estimate, the global power semiconductor market scale increased from 44.1 billion US dollars in 2017 to 46.4 billion US dollars in 2019. The global power semiconductor market will reach US $48.1 billion in 2022. According to IBS statistics, the market size of power devices in China will be about 71.1 billion yuan in 2021, and it is expected that the market size will increase to 110.2 billion yuan in 2025.

Because silicon carbide (SiC) devices have the characteristics of high voltage resistance and high frequency resistance, their use in new energy vehicles is expanding. At present, silicon carbide devices are mainly used in main drive inverter, OBC (on-board charger), DC-DC on-board power converter and high-power DCDC charging equipment. The miniaturization of silicon carbide devices can greatly reduce the power loss of new energy vehicles and make them work normally at 200 ℃; The characteristics of miniaturization and lightweight can reduce the energy consumption caused by the vehicle's own weight.

It is estimated that the market demand for SiC substrates for automobiles in China will be about 1.69 billion yuan in 2022. Benefiting from the growth of the new energy vehicle market and the expansion of the application of SiC products, the size of China's automotive SiC substrate market will reach 12.99 billion yuan in 2025, which will maintain an average annual growth rate of 97.2%. The replacement role of silicon based IGBT for automotive is gradually expanding. According to the cost proportion of silicon carbide devices (substrate, epitaxy and module account for 46%, 23% and 20% respectively), the market scale of silicon carbide devices for new energy vehicles in China will reach 28.24 billion yuan in 2025.

Automobile connector

Connectors are electronic components used for the exchange of electrical signals or optical signals between electronic system equipment. Automobile is the second largest application area of connectors after communication.

The application of connectors in automobiles mainly includes power system, safety system, on-board equipment, etc. The types of connectors include circular connectors, FCP connectors, I/O connectors, etc.

In 2021, the global auto connector market will grow to $17.08 billion, higher than the overall growth rate of global connectors in the same period. It is estimated that the global auto connector market will reach 19.452 billion dollars in 2025.

In addition, according to relevant institutions, the market size of China's automobile connector has been measured, and the penetration rate of new energy vehicles and intelligent driving has been judged. It is estimated that the market size of China's automobile connectors will reach 37.8 billion yuan in 2022, 67 billion yuan in 2025 and 22.04% in 2022-2024.

Automobile LCD instrument

Guotai Junan estimates that the market space of China's all-liquid crystal instrument will reach 30.1 billion yuan in 2025. In 2020, the market penetration rate of China's front-mounted all-liquid crystal instrument will be 27.2%, and it is expected to reach 55% in 2025. In 2025, the market space of China's on-board infotainment system will reach 48.8 billion yuan. In 2020, the market penetration rate of China's pre-installed on-board infotainment system will be 90.2%, and it is expected to reach 99% by 2025.

Contact us

Copyright © 2009-2020 HJC Electronic(HK) Limited.